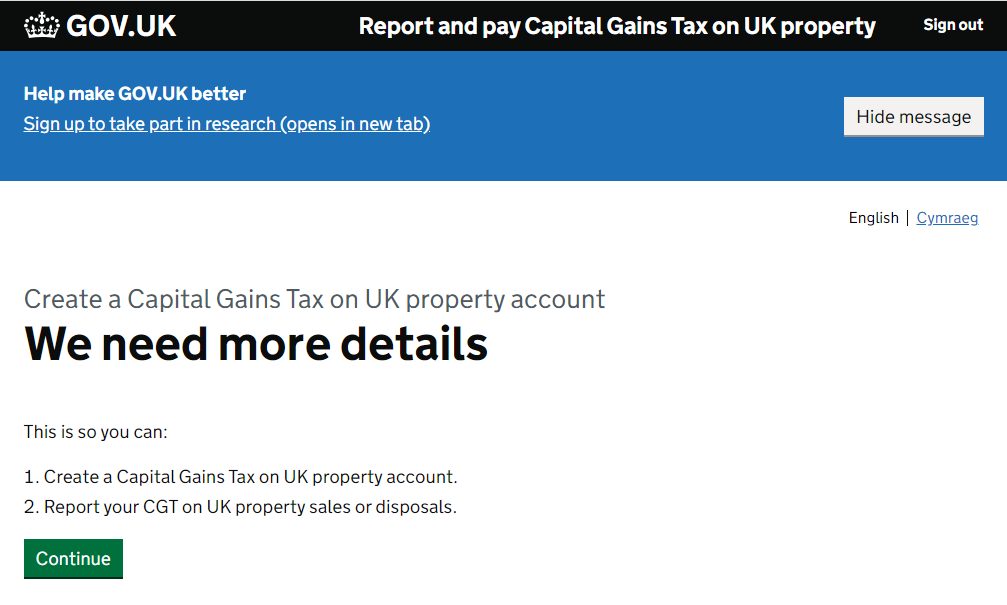

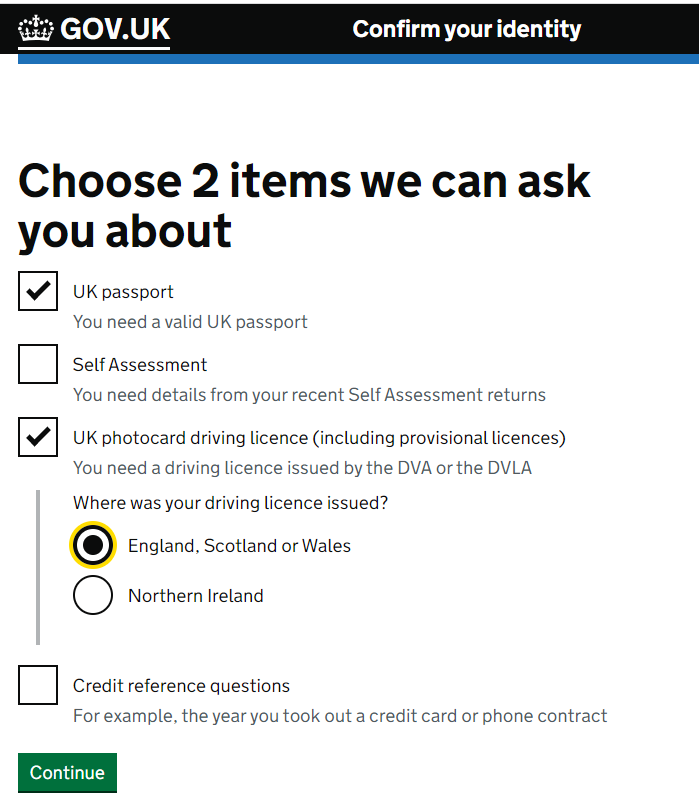

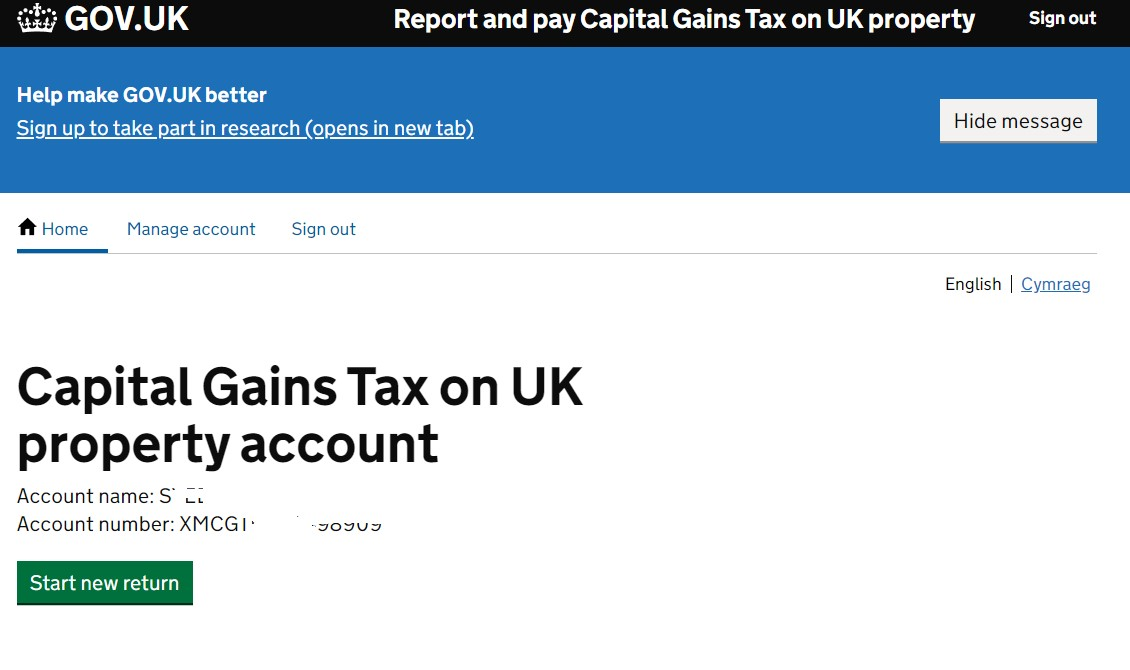

Once you click the green button, you will be taken to this page:

Guide

See below from HMRC:

You must report and pay any Capital Gains Tax due on UK residential property within:

You must report your own gain or loss. Special rules apply if you give a UK property to your spouse, your civil partner, or to charity.

Use a Capital Gains Tax on UK property account to:

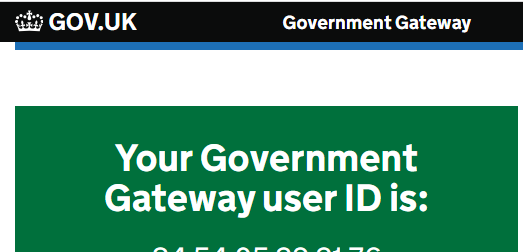

You’ll need a Government Gateway user ID and password to set up your account or sign in. If you do not have a user ID, you can create one the first time you sign in.

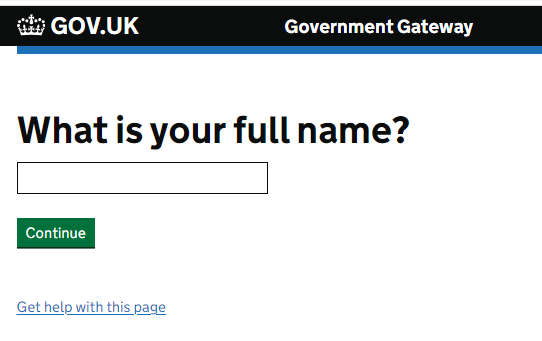

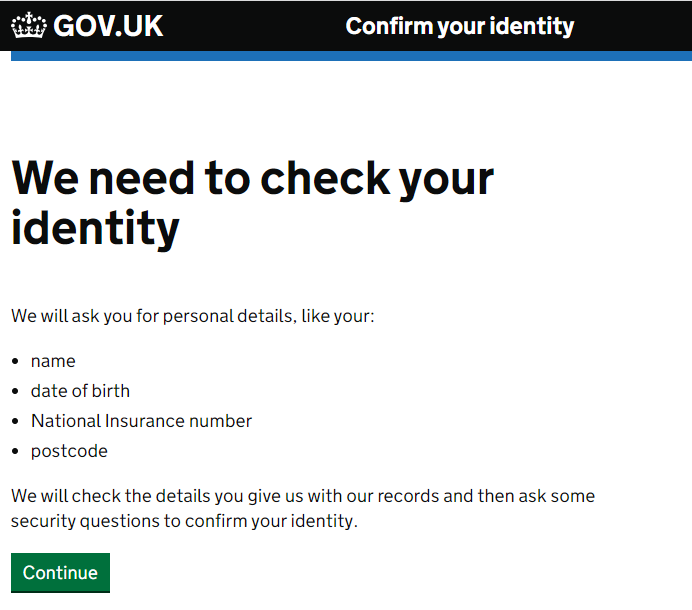

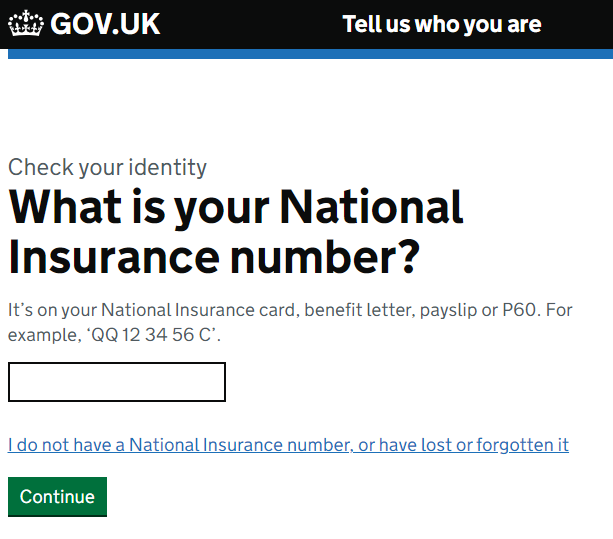

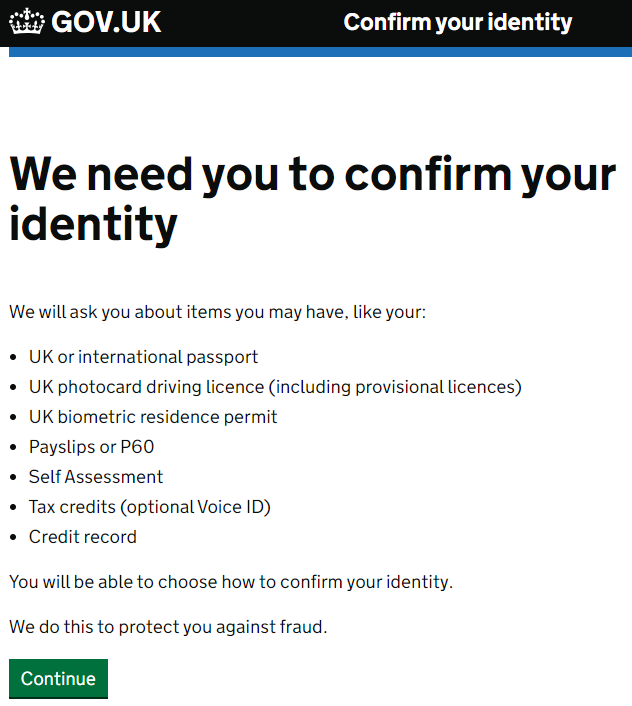

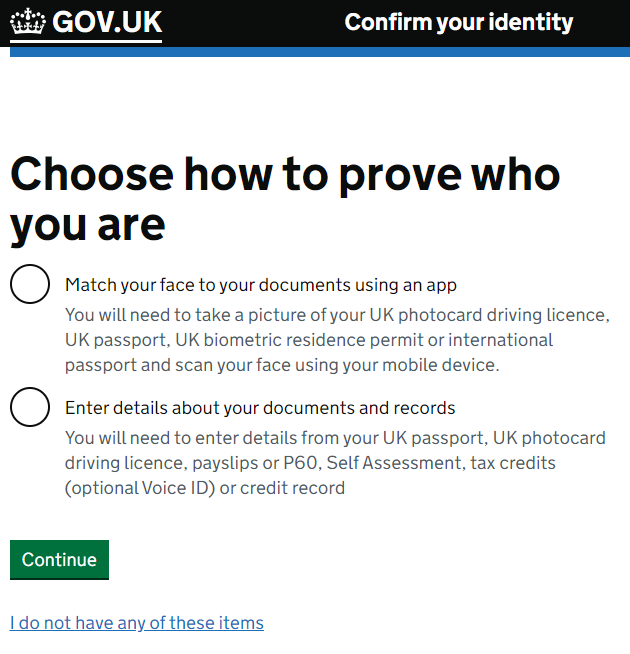

Once you click the green button, you will be taken to this page:

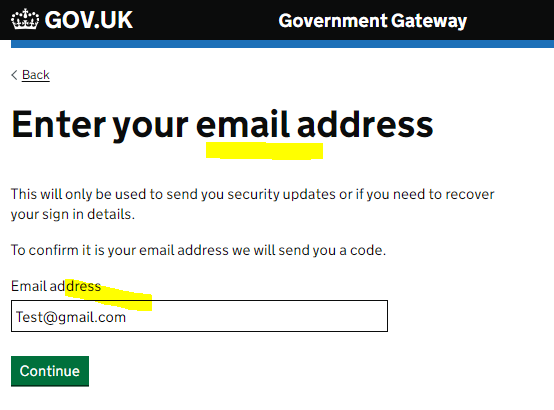

Next step will ask for your email:

Then it will send code to your email account:

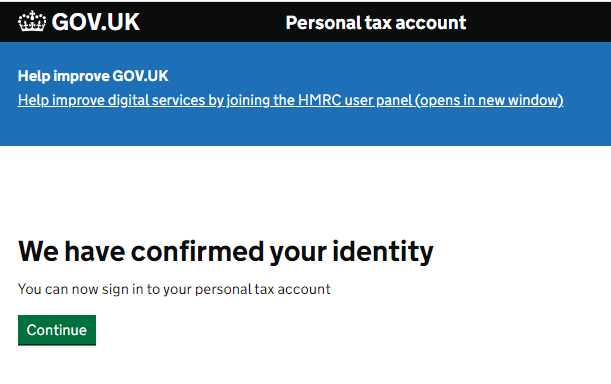

Once you have completed the above, jump back to complete our questionnaire.